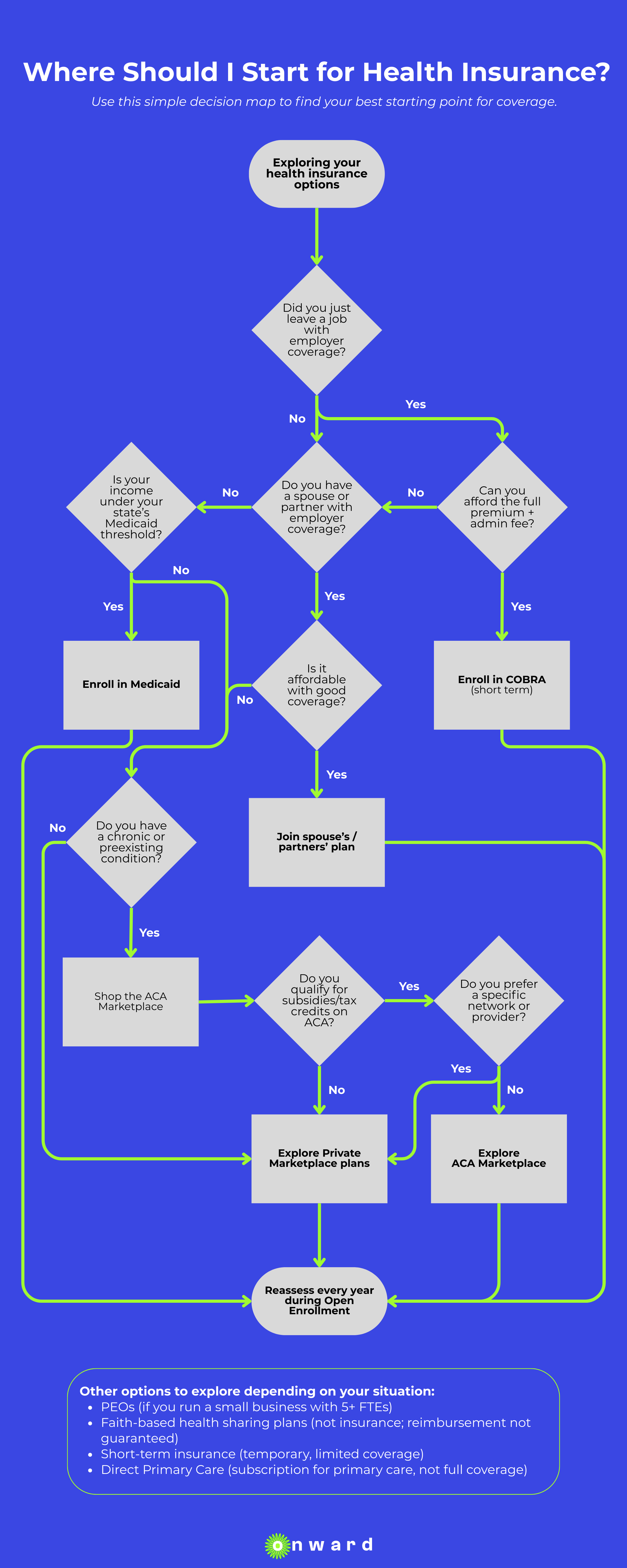

Flowchart: Health Insurance Options for Freelancers (US)

At Onward, we often say “no insurance required.” That’s because many of our partnerships from telehealth to mental health support to preventative diagnostics are designed to give you access without needing to navigate an insurance plan first.

But we also know this: health insurance is one of the biggest stress points for independent workers. It comes up again and again in conversations with our community. Whether it’s someone leaving a full-time job, a freelancer balancing costs, or a solopreneur trying to make sense of the marketplace.

Those conversations inspired us to create a simple tool: “Where Should I Start for Health Insurance?”

This flowchart isn’t meant to solve everything, but it gives you a clear starting point. Think of it as a map, built from the questions and real-life situations we hear every day from your peers.

Explore the chart below to see which path fits your situation. And if you want the full guide with pros, cons, watch-outs, and step-by-step guidance, you’ll find it inside the Onward Resource Hub launching soon.

This flowchart is here to give our community clarity and confidence, not formal insurance, legal, or tax advice. Everyone’s situation is different. When in doubt, check with a licensed insurance professional, healthcare expert, or tax advisor to make sure you have the coverage that’s right for you.

About Onward

Onward is a membership for healthcare, perks, and career support to help you thrive, no matter how your work is classified. Whether you’re self-employed, between gigs, or exploring alternatives, Onward gives you access to benefits that fit your life on your terms.

Learn more at onwardbenefits.com.